Buying a home is exciting, but inspections can be nerve-wracking. To make sure your investment is sound, understanding the inspection process is essential. This guide breaks down what an inspector does, how to read inspection reports, and how to tell major issues from minor ones. Let’s explore what you need to know to approach your home inspection confidently.

Home Inspections: What to Expect

A home inspection is like a comprehensive health check-up for a property. Most inspections are performed by general inspectors who identify red flags in a home’s structure and systems. If needed, they will suggest that you consult a specialist for further evaluation, such as an electrician or plumber.

Think of your inspector as a general practitioner. They look at everything broadly and point out areas that need more attention. For example, they might notice an issue with plumbing, but only a licensed plumber can evaluate the severity and cost.

Common Types of Inspections and Costs

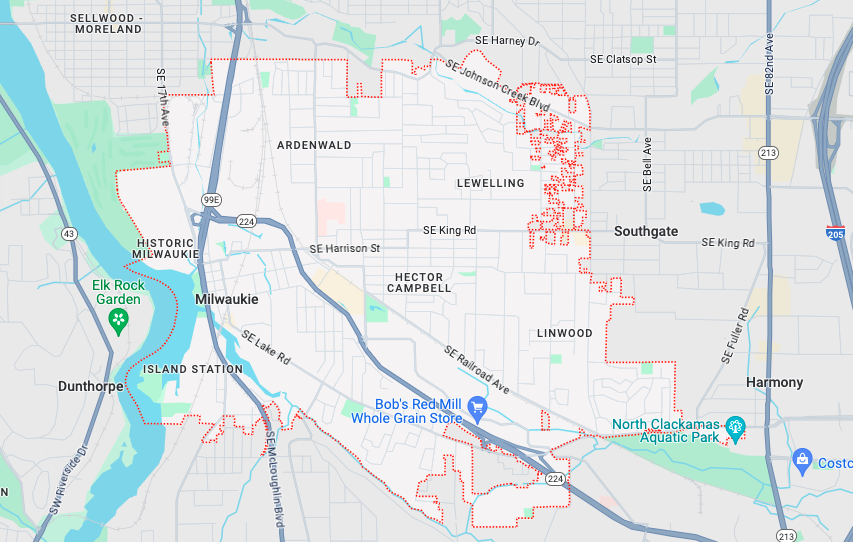

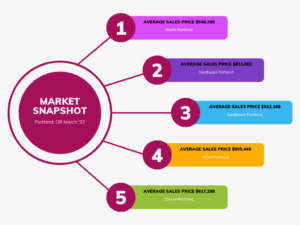

In the Portland area, buyers often encounter several types of inspections. Here’s what you should know:

- General Home Inspection

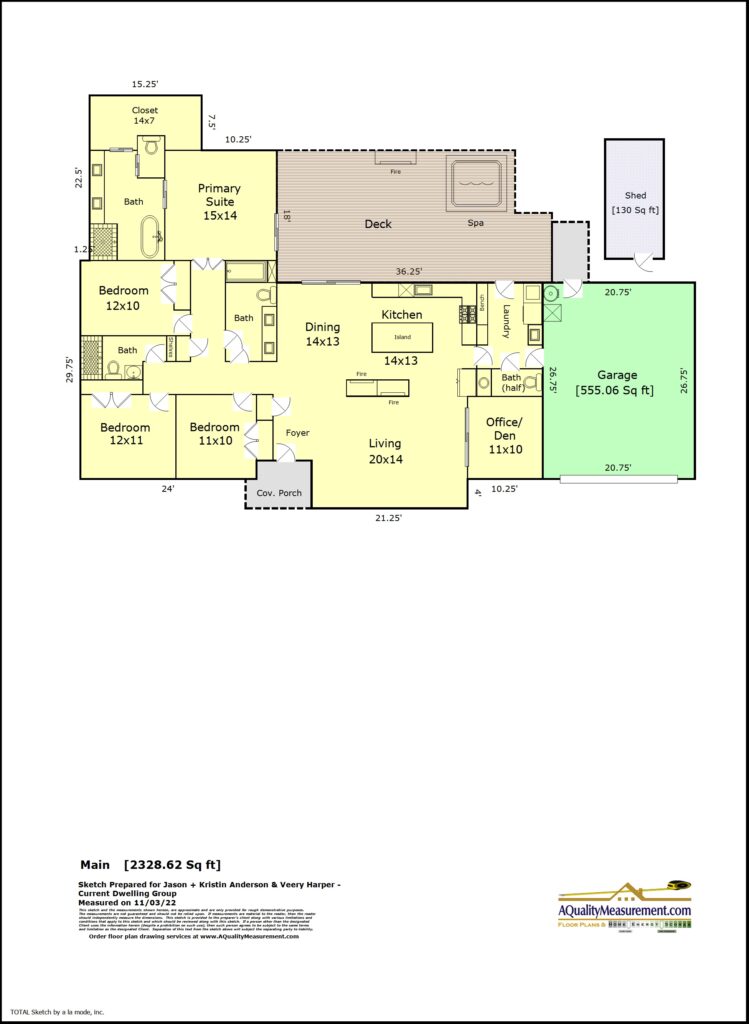

- Cost: $400–$600 (depends on property size)

- Details: This inspection covers the home’s major systems and overall structure.

- Sewer Scope

- Cost: $140–$175

- Details: A camera inspects the sewer line for proper connection and damage. This test helps prevent surprises with sewer repairs down the line.

- Radon Testing

- Cost: Often included in general inspections or available as an add-on

- Details: Radon is a naturally occurring gas. It can accumulate, especially in basements. Proper ventilation helps keep radon levels safe.

- Oil Tank Inspection

- Cost: $125–$150

- Details: Older homes may have underground oil tanks. These need decommissioning to prevent environmental risks.

- Septic Inspection

- Cost: Varies; the seller may cover pumping costs for inspection

- Details: If a home isn’t connected to city sewage, a septic inspection checks that the system works properly.

Common Issues Found During Inspections

Inspections often reveal issues. Understanding what’s critical versus cosmetic helps you navigate this stage smoothly. Here are common findings:

- Mold

- Mold is typical in the Pacific Northwest due to the wet climate. Professional mold remediation can fix the issue, provided the moisture source is corrected.

- Water in the Crawl Space

- This issue can be resolved with French drains and sump pumps. Water damage is serious, so addressing it promptly is key.

- Dry Rot

- Dry rot weakens wood. Small areas can be managed with targeted repairs. However, extensive dry rot requires immediate attention.

- Rodent Infestations

- Rodent problems are fixable. Sealing entry points and setting traps usually solve the issue. The cost can range from $800 to $1,000 over several months.

- Structural Concerns

- Vertical foundation cracks usually mean normal settling. However, horizontal cracks or diagonal ones around windows and doors may indicate a more serious issue.

Key Systems to Evaluate

During your inspection, certain systems deserve special attention:

- Plumbing: Inspectors will check copper, PEX, galvanized, and PVC pipes. Galvanized pipes, for example, corrode from the inside out and may need replacement.

- Electrical: Watch for outdated wiring like knob-and-tube, which poses fire risks. Also, check the electrical panel. Older panels, such as those from Federal Pacific, can have a higher chance of failure.

- Roof: The most common types are asphalt shingles, metal, and clay tiles. Asphalt roofs last 20–30 years, while metal can last up to 100 years.

- HVAC System: Make sure to check the age and efficiency of the system. A new HVAC system is a plus, especially during Portland’s hotter months.

Negotiating After the Inspection

Inspections often open the door for negotiations. Major issues, like a damaged roof or significant plumbing problems, can become points for discussion. However, don’t expect sellers to cover cosmetic upgrades or major remodels. Those responsibilities typically fall to the buyer.

Final Takeaways

A home inspection report can be overwhelming, but it’s an invaluable resource for understanding your investment. Prioritize issues based on their urgency and importance. Remember, every home, whether new or old, requires maintenance. Setting aside part of your budget for repairs and upkeep can help you manage these expenses smoothly.

Have questions or need help navigating the home-buying process in Portland? Reach out anytime. I’m here to ensure everything goes as smoothly as possible.

For more insights, watch the video: Navigating Your Home Inspection: Key Areas to Focus On

.

.

oliday season I promised myself that despite the typical holiday chaos, I would try to take some time for myself and do something fun that I’d been putting off. Binge watching the

oliday season I promised myself that despite the typical holiday chaos, I would try to take some time for myself and do something fun that I’d been putting off. Binge watching the

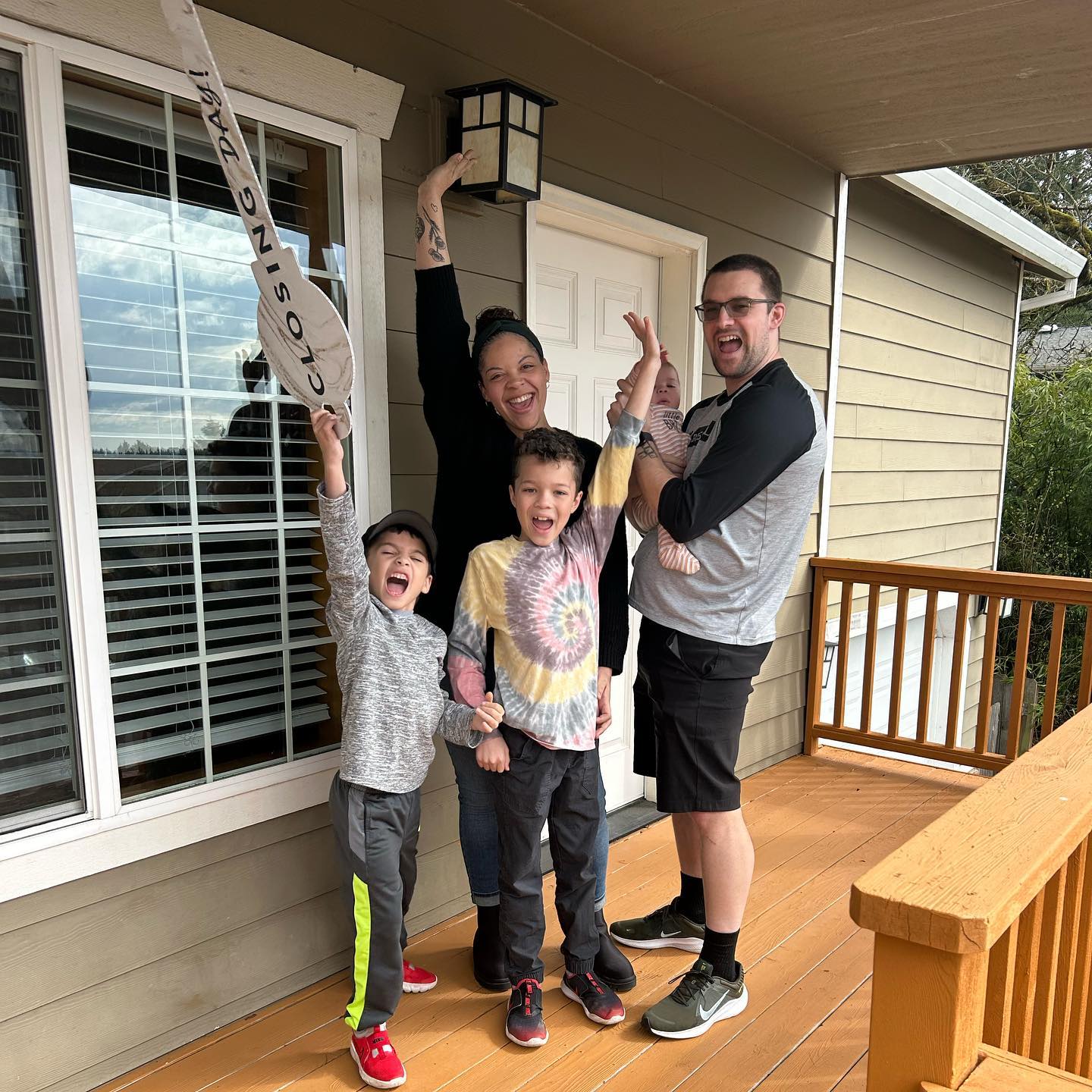

A thanksgiving story — not in a traditional, seasonal holiday sense with turkey and stuffing and finding enough matching place settings for all the folks trundling your way, but one of some of the dearest clients: maybe-buyers I had the wonderful good fortune to meet in a lovely home I had held open in September, located smack dab in the neighborhood they’ve been rooted in together for years – they’d lived just a block away from there “close enough to get to Salt & Straw very quickly” being one of the qualifiers on location as it would turn out. Meeting these two immediately warmed my heart and enriched my life, setting us on a journey to find a solution together for the challenge they were facing: repair their current home, or search for something new to close a difficult chapter for them and move on from the loss and heartache brought on by a house fire Christmas eve 2021. They lost their cherished home they’d poured so much time and energy into. While they were originally planning to rebuild, they saw the above mentioned home in their neighborhood, OPEN HOUSE sign out front, and somehow that rekindled the sense that they could find something new to love and grow into.

A thanksgiving story — not in a traditional, seasonal holiday sense with turkey and stuffing and finding enough matching place settings for all the folks trundling your way, but one of some of the dearest clients: maybe-buyers I had the wonderful good fortune to meet in a lovely home I had held open in September, located smack dab in the neighborhood they’ve been rooted in together for years – they’d lived just a block away from there “close enough to get to Salt & Straw very quickly” being one of the qualifiers on location as it would turn out. Meeting these two immediately warmed my heart and enriched my life, setting us on a journey to find a solution together for the challenge they were facing: repair their current home, or search for something new to close a difficult chapter for them and move on from the loss and heartache brought on by a house fire Christmas eve 2021. They lost their cherished home they’d poured so much time and energy into. While they were originally planning to rebuild, they saw the above mentioned home in their neighborhood, OPEN HOUSE sign out front, and somehow that rekindled the sense that they could find something new to love and grow into.

Back in 2011 I met one of my very favorite buyers ever, Mel. She worked with the Portland Housing Center and had $9,000 to from a matched savings account through Portland Housing Center. She used that $9,000 for a 5% downpayment on an oh so very vintage 760 sf 1920’s bungalow in Arbor Lodge that she bought for $180,000.

Back in 2011 I met one of my very favorite buyers ever, Mel. She worked with the Portland Housing Center and had $9,000 to from a matched savings account through Portland Housing Center. She used that $9,000 for a 5% downpayment on an oh so very vintage 760 sf 1920’s bungalow in Arbor Lodge that she bought for $180,000.

into homeownership and creating longitudinal wealth.

into homeownership and creating longitudinal wealth.

My buyer Theo wins the award for the single most expensive repair I have negotiated for a buyer. Theo was a first time buyer who was referred to me by a past client of mine who they work with. We met up on a chilly fall evening to talk about what they were looking for in a house and get the process started. Within a couple of days, Theo had their pre-approval letter in hand and we were ready to go. I sent them all of the available homes within the geographic boundaries, price range and features they were looking for. The list wasn’t very long and out of all of them, only 2 houses piqued their interest. We went to see one in NE, and that was a no-go. The second house we saw was bright blue 1920’s bungalow in the Brooklyn neighborhood. It had been on the market for about a month and had one sale fail. The home was lovely with a gigantic newly remodeled kitchen and a large upstairs bedroom with room to add a bathroom. The basement was decent enough with lots of windows and good ceiling height- a great candidate for future finishing. Theo slept on it and the next morning let me know they wanted to write on it. We put together a great offer and boom- got it accepted.

My buyer Theo wins the award for the single most expensive repair I have negotiated for a buyer. Theo was a first time buyer who was referred to me by a past client of mine who they work with. We met up on a chilly fall evening to talk about what they were looking for in a house and get the process started. Within a couple of days, Theo had their pre-approval letter in hand and we were ready to go. I sent them all of the available homes within the geographic boundaries, price range and features they were looking for. The list wasn’t very long and out of all of them, only 2 houses piqued their interest. We went to see one in NE, and that was a no-go. The second house we saw was bright blue 1920’s bungalow in the Brooklyn neighborhood. It had been on the market for about a month and had one sale fail. The home was lovely with a gigantic newly remodeled kitchen and a large upstairs bedroom with room to add a bathroom. The basement was decent enough with lots of windows and good ceiling height- a great candidate for future finishing. Theo slept on it and the next morning let me know they wanted to write on it. We put together a great offer and boom- got it accepted.

Sarah and Tariq contacted me in early August after being referred to me by one of my favorite lenders. They used to live in Portland, and had moved to Los Angeles for work, and were now being transferred back to Portland. They were moving to Portland in mid-November, so they came to Portland in mid-October to find a home. Before they arrived, we had a flurry of emails back and forth narrowing down homes they wanted to see. They seemed to really hone in on mid-centuries and when we came up with our list of homes to see over the next few days, the majority were mid-centuries. They arrived on a Thursday evening, and we hit the ground running on Friday morning. We saw around 12 houses together over the next couple of days, and they saw even more homes on their own visiting open houses.

Sarah and Tariq contacted me in early August after being referred to me by one of my favorite lenders. They used to live in Portland, and had moved to Los Angeles for work, and were now being transferred back to Portland. They were moving to Portland in mid-November, so they came to Portland in mid-October to find a home. Before they arrived, we had a flurry of emails back and forth narrowing down homes they wanted to see. They seemed to really hone in on mid-centuries and when we came up with our list of homes to see over the next few days, the majority were mid-centuries. They arrived on a Thursday evening, and we hit the ground running on Friday morning. We saw around 12 houses together over the next couple of days, and they saw even more homes on their own visiting open houses.

My buyers Annie and Ben were referred to me by one of the great lenders at Portland Housing Center. They were first time home buyers and during our meeting when we met to discuss their plan and get a feel to see if we would be a good fit to work together, we talked about the ideal house for them. They had a really clear idea of exactly what they were looking for and where they wanted to buy. Ben works in Vancouver and Annie works on the inner east side so their ideal house would be in North Portland in Kenton or near I-5. They also wanted something with vintage charm- preferably mid-century, and in good shape that would be easy to maintain. They also wanted a yard and their budget was $400k tops. They were still interviewing agents when a couple of days after we met, I got an email from my wonderful colleague Martin Cross here at Living Room with info on an open house a great listing of his in Kenton was having the next day. On paper that house seemed to meet all the criteria that Annie and Ben had, so I forwarded the email along to them. They responded that indeed, the house looked like it was great and they could tell I had a really good sense of what they were looking for, and that sealed the deal for us working together.

My buyers Annie and Ben were referred to me by one of the great lenders at Portland Housing Center. They were first time home buyers and during our meeting when we met to discuss their plan and get a feel to see if we would be a good fit to work together, we talked about the ideal house for them. They had a really clear idea of exactly what they were looking for and where they wanted to buy. Ben works in Vancouver and Annie works on the inner east side so their ideal house would be in North Portland in Kenton or near I-5. They also wanted something with vintage charm- preferably mid-century, and in good shape that would be easy to maintain. They also wanted a yard and their budget was $400k tops. They were still interviewing agents when a couple of days after we met, I got an email from my wonderful colleague Martin Cross here at Living Room with info on an open house a great listing of his in Kenton was having the next day. On paper that house seemed to meet all the criteria that Annie and Ben had, so I forwarded the email along to them. They responded that indeed, the house looked like it was great and they could tell I had a really good sense of what they were looking for, and that sealed the deal for us working together.